is a car an asset for fafsa

Not your car and liquid meaning you can easily turn them into cash. Your car loses value the moment you drive it off the lot and continues to lose value as time goes on.

No the FAFSA specifically does not ask about cars boats planes jewelry retirement accounts and the family home.

. Not Filling out the FAFSA. The equity available in the home you live in. Other assets students and parents can leave off of the application include the value of.

First its important to note that parental assets and the childs assets are treated differently on the FAFSA. 10 rows An asset is essentially any money that you have readily available. FAFSA - Free Application for Federal Student Aid.

Below is a list of assets you do not need to include when filing your FAFSA. As a general rule you should only report assets that are cash-based ie. Clothing furniture electronic equipment personal computers appliances cars boats and other personal possessions and household goods are not reported as assets on the FAFSA and CSS Profile.

You still need to list your bank account totals as an asset. Commodities investments gold silver etc Qualified educational benefits or education savings accounts such as Coverdell savings accounts 529 college savings plans the refund value of 529 prepaid tuition plans. Any assets in the students name is assessed at a flat 20 percent rate.

NO its not an asset on the FAFSA but it is on the Profile. If your account balance falls below your Asset Protection Balance you will not have to report the account. 529s owned by your ex-spouse.

YES theyre an asset. If you read each question carefully you will see they want cash and investments like money markets stocks bondsno where do they ask about cars. The home in which you live.

Created Jul 4. Before your family fills out the FAFSA check out the 14 biggest mistakes you should avoid to optimize the amount of money your family receives in financial aid. But its a different type of asset than other assets.

According to the FAFSA a car a computer a book a boat an appliance clothing and other personal property is not included in the asset description. Its essential to understand how assets whether. The car also isnt reported as an asset on the FAFSA.

So Im currently filing out my fasfa and I am stuck on the parents assets questions. Reportable assets are based on the net worth after subtracting any debts that are secured by the asset. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA.

Home maintenance expenses are also not reported as assets on the FAFSA since the net worth of the familys principal place of residence is not reported as an asset. Your car is a depreciating asset. Things like trust funds and 529 savings plans if theyre owned by you or your parent do need to be reported as well as more obvious things like your bank balances.

The car also isnt reported as an asset on the FAFSA. The car loan is not relevant to FAFSA calculations and cars are not an asset for their purposes. The short answer is yes generally your car is an asset.

The FAFSA also isnt interested in having parents cash out their life insurance for their childrens education so dont include that information. Any assets in the students name is assessed at a flat 20 percent rate. In several situations there is not a requirement to report your 529 Plan as an asset on the FAFSA.

DONT include these investments as assets on the FAFSA. Animals and Pets Anime Art Cars and Motor Vehicles Crafts and DIY Culture Race. Clothing furniture electronic equipment personal computers appliances cars boats and other personal possessions and household goods are not reported as assets on the.

Additionally if your grandparents are the owners of the 529 Plan account you will not have to. The value of life insurance. Cash values of whole life insurance policies and qualified annuities are not reported on the FAFSA.

The value of your life insurance. This would include 401K IRA pension funds and so on. You can also learn more about financial aid by watching one of our recorded webinars.

How different assets are reported on the FAFSA. This balance is typically around 10000. Value of insurance policies and annuities.

UTMA or UGMA accounts. However non-qualified annuities are counted as assets on the CSS Profile a form used by many schools to determine non-government aid eligibility. And distributions from it are student income in the year theyre received.

Other investments are reported on the FAFSA application including bank accounts brokerage accounts and investment real estate other than the primary home. But for parents there is a protection allowance of 30000 to 60000 based on the age of the oldest parent living in the. Parental vs student assets.

Check out College Financing Understanding the FAFSA or The CSS Profile anytime. YES theyre an asset specifically the students asset. UGMA UTMA accounts where you are listed as the custodian and do not own.

According to the FAFSA house maintenance expenses as well as the capital gains on the family residence are classified as part of the primary residence property asset category. Trusts for which you or the student are a. My dad is retired and he receives a monthly pension from multiple sources.

Simple And Easy Ways To Learn About Finance

Student Loans Vs Auto Loan Which Should I Pay Off First The Motley Fool

16 Budgeting Tips Every Single Woman Needs To Know Gobankingrates

Is My Car An Asset Or A Liability

How To Drive A Nicer Car Than You Thought Possible Money Under 30

Kresge Weekly Newsletter 2020 2022 Kresge Foundation

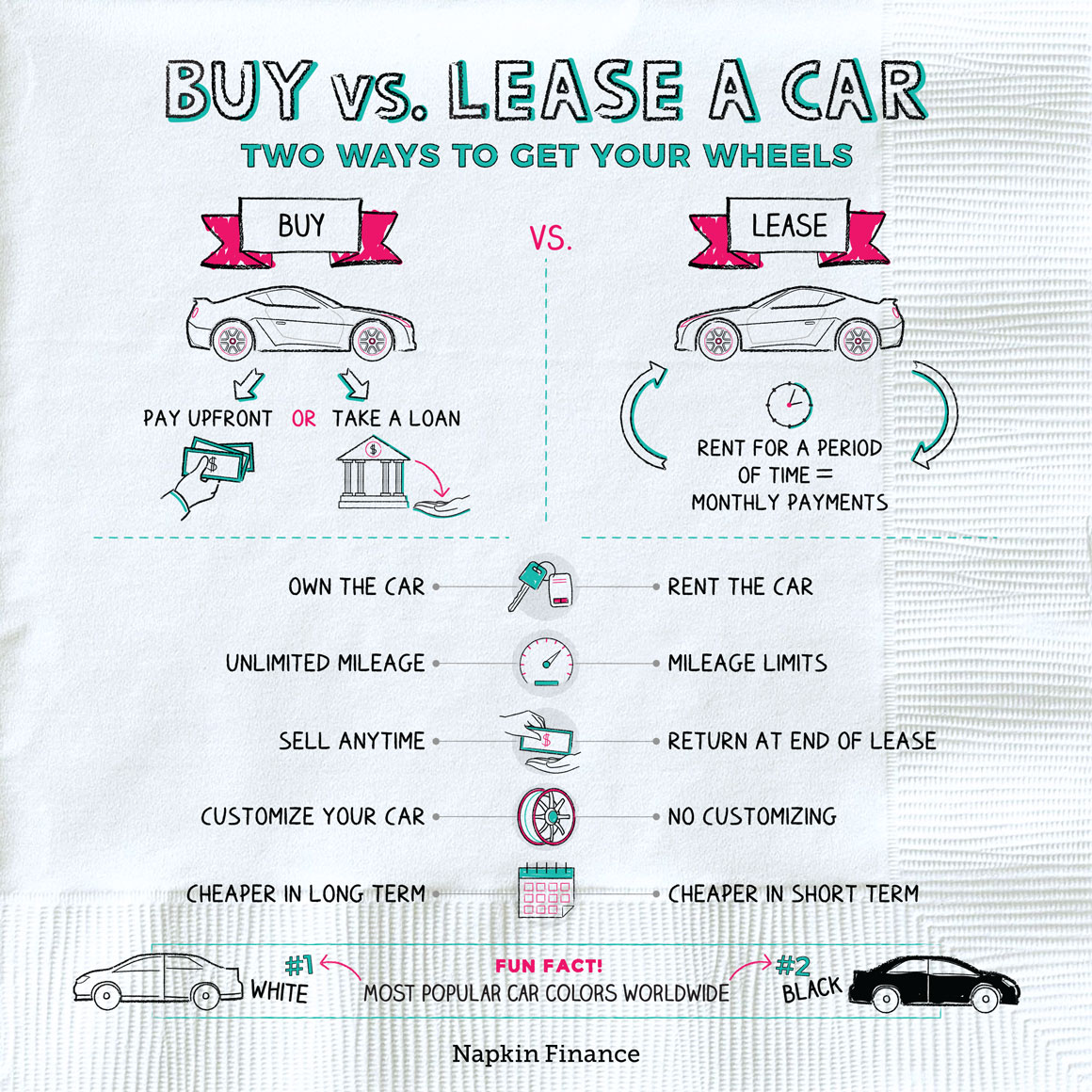

Leasing A Car Is A Bad Financial Move For College Students

Car Depreciation How Much Have You Lost New Cars Infographic Car Insurance

Low Cost Car Leasing It S Back Cbs News

Middle Income Boomer Retirement Gap Infographic Timber Trails Enabling Cabin Cottage And Tiny House Build Finance Education Saving For Retirement Life

Can You Use Student Loans For A Car Purchase Student Loan Planner